Home Explorer facilitateur de mobilité,

changer de lieu de vie

facilement

sereinement

rapidement

Pourquoi choisir Home Explorer pour vous accompagner dans votre mobilité ?

Depuis 2005, nous facilitons l’installation des salariés et de leurs familles dans leur nouvelle région, suite à une mutation ou un recrutement. Un consultant référent est à vos côtés pour vous épauler dans la recherche de logement et l’ensemble des démarches liées à votre mobilité.

Une agence

d’expérience

Forts de leur expérience et de leur connaissance de la région, du marché immobilier local et de ses acteurs,

nos consultants Home Explorer sont un véritable appui logistique et un soutien moral pour bien vivre votre mobilité.

Un accompagnement

sur mesure

Parce que chaque projet est unique, notre approche personnalisée prend en compte votre situation professionnelle, familiale et financière. L’ensemble de nos services permettent de répondre à chacune de vos attentes dans toutes les étapes de votre installation.

Une équipe

mobilisée et réactive

Chez Home Explorer, le contact humain est primordial. Nous nous engageons à vous contacter sous 24h. Vous disposez d’un contact privilégié et permanent avec votre consultant référent pendant toute la durée de la mission.

Des services de relocation personnalisés

pour tous les salariés

Home Explorer partenaire mobilité des entreprises depuis 2005

Home Explorer est avant tout le partenaire des services de ressources humaines.

Nous facilitons la mobilité de vos salariés en nous concentrant sur leur bien-être et celui de leur famille.

Nous confier leur accompagnement permet un gain de temps, une maîtrise des coûts de mobilité, une

meilleure intégration tout en valorisant votre marque employeur.

Une équipe d’experts réactive

à votre écoute

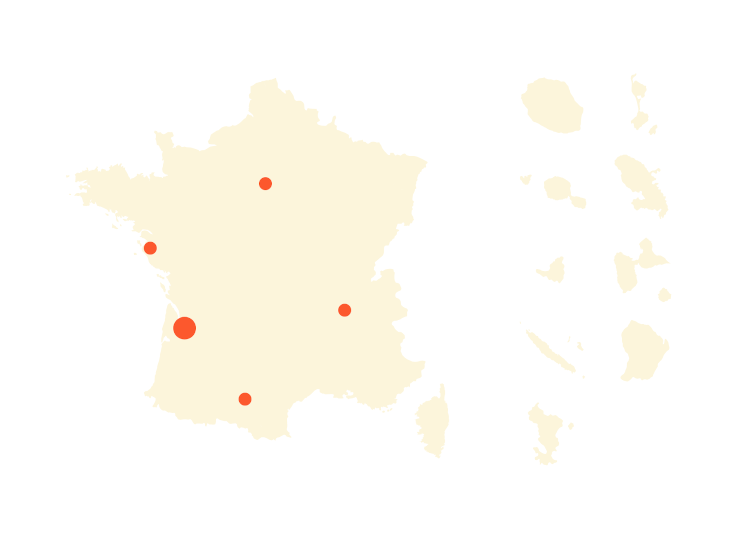

Un réseau qualifié pour vous accompagner

partout en France

Implantée physiquement à Bordeaux, l’agence possède un réseau de consultants

et partenaires qualifiés sur l’ensemble du

pays.

Nous pouvons répondre à tout type de mobilité professionnelle et géographique.

Ils nous font confiance

Ce que nos clients pensent de nous

« Je recommande ! »

Home Explorer m’a trouvé un logement correspondant tout à fait à mes critères malgré la complexité du marché bordelais. Je suis très satisfait de leurs services et je les recommande sans hésitation !

Guillaume L.

Cdiscount

« Un grand MERCI »

Vingt-sept appartement dans trois villes différentes entre 11h et 16h avec sept agences différentes. Seul je n’y serai pas arrivé pour des rdv et les planifier. Un grand MERCI à home explorer.

Patrick L.

Satif

« Très bon service »

Grande disponibilité, écoute au top et bons conseils.

Fabien B.

Dassault Aviation

Agence de relocation à Paris

Chaque année, la capitale accueille de nombreux actifs intra et extramuros. Le marché immobilier tendu de Paris peut être intimidant et source de stress. Arrondissements, choix de quartiers, quelle ligne de métro prendre ? De nombreuses questions subviennent lorsque l’on s’apprête à poser ses valises dans la ville lumière ! Faire appel à une agence de relocation permet d’appréhender au mieux les questions liées à cette mobilité. Grâce à la réactivité et la disponibilité de nos consultants franciliens, vous trouverez votre bien au plus vite et les démarches liées à votre déménagement seront facilitées !

Agence de relocation à Lyon

Troisième plus grande ville de l’hexagone, Lyon, réputée pour être une ville étudiante, attire chaque année beaucoup de jeunes actifs. Ainsi, trouver le bien de ses rêves peut s’avérer compliqué face à la demande croissante de logements ! Avec leur connaissance de la ville et leur carnet d’adresses, nos consultants lyonnais seront un véritable atout pour dénicher votre nouveau chez-vous ! Que vous soyez en mobilité depuis la France ou depuis l’étranger Lyon n’attend plus que vous !

Agence de relocation à Bordeaux

Embellissement de la ville, LGV depuis Paris, arrivée d’entreprises et sièges sociaux… Bordeaux séduit depuis plusieurs années et voit sa population augmenter massivement. La demande immobilière est forte et les agences sont particulièrement sollicitées. Nos consultants mettront à votre disposition leur réseau pour permettre une recherche de logement en toute sérénité.

Agence de relocation à Toulouse

Depuis plusieurs années, la ville rose est de plus en plus attractive. Ville du sud de la France, c’est indéniable : à Toulouse il fait bon vivre ! Vous êtes en recherche de logement? Que vous soyez alternant, salarié muté ou recruté, vos démarches peuvent être réalisées par une société d’accompagnement à la mobilité. Nos services proposent également des conseils sur la ville à l’accent chantant et son marché immobilier. Nous avons à cœur d’être les plus efficaces possible dans votre recherche.